Table of Content

The home loan tax benefits are applicable as per Income Tax Act 1961. This certificate demonstrates that IIFL as an organization has defined and put in place best-practice information security processes. Incorporated in 1969, Elin Electronics Limited is a leading electronics manufacturing services ("EMS") provider.

You may, however, make additional monthly payments which are applied directly to the principal amount thus reducing your mortgage term substantially. Some home loans offer attractive monthly mortgage payments but at times those low payments don't cover the interest portion of the loan. When that happens, part of the principal amount is deducted, resulting in what lenders call "negative amortization." Simply put, it means you are losing equity in your home.

Can Fin Home Loan FAQs

You agree, in the event of any dispute arising in relation to these Terms and Conditions or any dispute arising in relation to the Website whether in contract or tort or otherwise, to submit to the jurisdiction of the courts located at Mumbai, India for the resolution of all such disputes. Attempt to decipher, decompile, disassemble, or reverse engineer any of the software, comprising or in any way making up a part of the Website or the facilities. Post or transmit any file which contains viruses, worms, Trojan horses or any other contaminating or destructive features, or that otherwise interferes with the proper working of the Website or the facilities. We reserve the right to terminate access to this Website at any time and without notice.

Any recommendation or reference of schemes of ABSLMF if any made or referred on the Website, the same is based on the standard evaluation and selection process, which would apply uniformly for all mutual fund schemes. You are free to choose the execution facilities in the manner deemed fit and proper and no commission will be paid by ABSLMF to ABML / ABFL if you choose to execute a transaction with ABSLMF on the Website, unless otherwise agreed by you and ABML/ABFL separately. Information about ABML/ABFL, its businesses and the details of commission structure receivable from asset management companies to ABML/ABFL, are also available on their respective Website.

Keep Reading

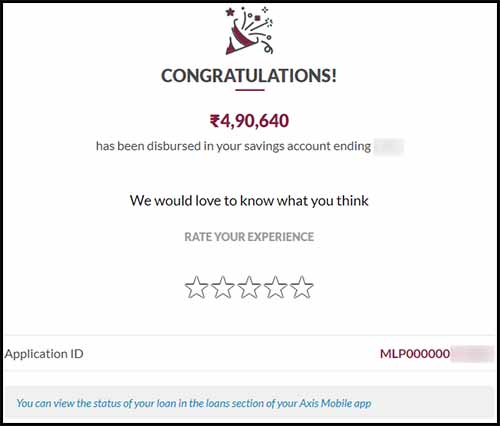

Remember, with updated repayment records, you can get benefits like lower home loan interest rates, relaxed eligibility, etc., in case you get another loan. Settled loan closure - Settled loan closure is a situation wherein a borrower is unable to pay off the entire loan amount and therefore, the lender offers the borrower a discounted rate to pay towards the overdue amount of the loan. The loan is repayable in Equated Monthly Instalments comprising both principal and interest. EMI is to be paid on a fixed date every month and will commence from the month following the month in which your loan is fully disbursed. Till such time the loan is fully disbursed, interest on the loan amount which has already been disbursed is to be paid every month.

The Website reserves the right to withdraw, discontinue, modify, extend and suspend the Promotional Offer and the terms governing it, at its sole discretion. To help you for your money needs you can avail the facility of MoneyForLife Planner (‘MoneyForLife Planner/ Planner’). MoneyForLife Planner facility is powered by Aditya Birla Money Limited, a subsidiary of ABCL. MoneyForLife Planner provides an indicative assessment of your money needs based on the factors like income, age, family members and their future, your future money requirements and current lifestyle status as per details filled in by you on the online questionnaire. The Planner provides an indicative view about the generic investment opportunities available in the manner indicated by you.

Confirm there are no outstanding dues

The information contained herein is generic in nature and is meant for educational purposes only. Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product. Readers are advised to exercise discretion and should seek independent professional advice prior to making any investment decision in relation to any financial product. Aditya Birla Capital Group is not liable for any decision arising out of the use of this information.

Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your advisor or other financial advisers who are fully aware of your individual circumstances. For more details, please also refer to the Legal Disclaimers provided on the Website. Upon any change, the updated Terms of Use will be updated on the Website or any other means. Your continued use of the facilities on this Website constitutes acceptance of the changes and an Agreement to be bound by Terms of Use, as amended.

Information is supplied upon the condition that the persons receiving the same will make their own determination as to its suitability for their purposes prior to use or in connection with the making of any decision. Neither ABCL and ABC Companies, nor their officers, employees or agents shall be liable for any loss, damage or expense arising out of any access to, use of, or reliance upon, this Website or the information, or any website linked to this Website. You have the option to withdraw the said consent in the manner specified under these Terms of Use.

Up to 75% of the purchase price or value of the home can be arranged. It is very easy to access the available credit, with many lenders also providing an issued credit and/or debit card. The money does not have to be drawn until you need it, and you can pay off your balance at any time or make monthly payments. As the balance is paid down, there is much more available credit .As it is a secured product, the conventional legal and appraisal fees are applicable. Now and then, there are promotions where a lender will cover part or all of these costs.

Revalidation FeeRs 500Pre-closure chargeNILPrepayment charges NIL for up to 10% of the opening principal balance in a financial year. Pre-closing a loan means clearing off your dues with a single payment. Pre-payment means making part payments on your loan over and above your EMIs.

This penalty is customarily three months interest, or the interest rate differential. H Harish Kumar Gupta from Delhi, Delhi Nov 19, 2020 This thread was updated on Nov 19, 2020 I had taken a housing loan in March'2004 from CanFin Homes Limited, a subsidiary of Canara Bank. As per my loan sanction letter, there would only be a prepayment charges @3% in case of the loan libility is taking over by any other financial / lending institution. A borrower can also preclose a housing loan to save up on interest. Closing off a loan before the term is due allows the borrower to evade a part of the interest. Any interest he/she was supposed to pay post preclosure will automatically be waived off on closing the loan.

The information is dependent on various assumptions, individual preferences and other factors and thus, results or analyses cannot be construed to be entirely accurate and may not be suitable for all categories of users. Hence, they should not be solely relied on when making investment decisions. Any information and commentaries provided on the Website are not meant to be an endorsement or offering of any stock or investment advice. Your right to use the facilities is personal to you; therefore, you agree not to resell or make any commercial use of the facilities. In addition, the Website welcomes your feedback as a user of the facilities. Any feedback you provide will become the confidential and proprietary information of the Website, and you agree that the Website may use in any manner and without limitation, all comments, suggestions, complaints, and other feedback you provide relating to the Website.

Several lenders ask loan applicants to provide post-dated cheques in case you default on any EMIs. Collect these cheques after loan repayment if you haven’t missed any EMIs. On a side note, if you’ve struggled with paying EMIs on time, use a home loan EMI calculator to estimate repayments in advance the next time you apply. Low Credit Scores will result in higher payments on loans, credit cards, and insurance. The credit score is calculated by a statistical process and provides a guideline for lenders to extend credit to a borrower.

DisclaimerBy entering my contact information I give my express consent to be contacted by 'Canfin Realty Services Inc.' and or real estate salespeople on behalf of 'Canfin Realty Services Inc.' to discuss potential services. Use this calculator to determine your monthly payment and amortization schedule. This canfinhomes ltd has worst recruitment, i haven't seen before such a hiring preplanned got money and some people were recommended ones. I have my funds ready to close the loan and I am waiting for your approval to close the loan before imposing EMI next month.

Repay the outstanding amount and collect the original property documents from the lender. A tool to help you estimate the premium payable when you are purchasing a home. Simply enter the purchase price, down payment and the amortization period. It will normally only take a few days to receive approval for a mortgage, however, it is often recommended to get pre-approval for a mortgage.